PRESIDENT’S CORNER

6

Almond Facts

MARCH | APRIL 2016

President’s Corner

Mark Jansen

President and CEO

Marketing Needed

to Grow Demand

Much of the almond industry believes they are

“marketing” almonds by letting their call pool

handler inform its broker that they are ready to

sell. Respectfully, this is confusing marketing with

trading, which is no more than taking advantage of

timing. Marketing is distinguished by understanding

consumer needs, developing new products, building

brands and collaborating with customers to generate

profitable demand for almonds. Marketing is always

an effective strategy, but there are times when a

trading strategy can be nearly as effective. The

industry just completed one those eras when trading

almonds was so profitable that it attracted many new

entrants to the industry.

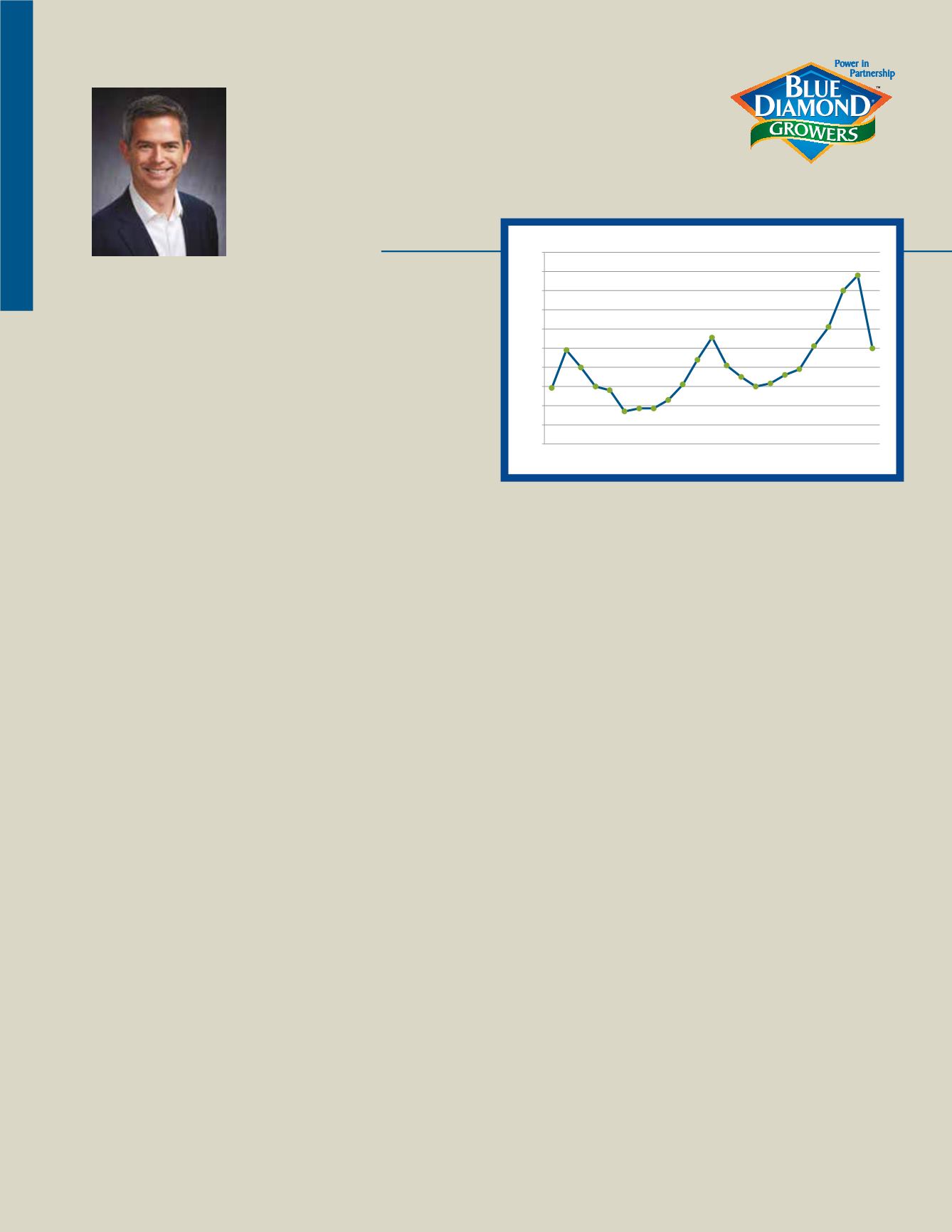

For more than six years, the market prices for almonds

consistently rose, never selling for less than the previous year.

As the drought suppressed yields, prices spiked. By last summer,

almonds had become the most costly tree nut. It was a good

time to strengthen balance sheets of growers and handlers.

As prices reached historically high levels, the industry

experienced a reduction in market demand. In times

of tight supplies, price is used to ration the available

quantities. However, demand-erosion occurred and pricing

had become over-inflated.

Blue Diamond’s

strategic plans anticipated the 2015 crop to

be the peak of almond prices over our five-year planning

horizon. We forecasted an El Niño water year, combined

with increasing acreage, would result in expectations for

larger future crops and price changes.

The unexpected news of a healthy 2015 crop with a slight

increase in market supply triggered the price decline. The

speed of the price correction unsettled the market. Purchases

were made at prices $1.50 above current market by the time the

product reached the customer. When those customers needed

to resell, they sometimes defaulted on those contracts leaving

containers orphaned in port, searching for new customers.

Later, they sold at discount to the already lower market prices,

further contributing to the downward pricing spiral.

It seems counter-intuitive, but lowering prices reduced

demand. This deflationary environment caused buyers to

delay purchases and even reduce consumption. They knew

that by waiting prices would go lower. Price stability or

defining a floor to prices was necessary to give buyers the

confidence to buy now.

As I write this article, it appears market prices have returned to

historically normal levels or similar to those of 2012. California

growers, the most productive, efficient and sustainable in

the world, are better positioned to maintain profitability at

these economic levels, but other producing countries will be

pressured to break-even. This gives us a platform from which

to restore market confidence and rebuild demand.

Blue Diamond

is a marketing co-op. Our business is almond

demand generation. In the last five years we have tripled our

advertising expenditures, continued to innovate new almond

products, opened 45 international markets to our consumer

brand and achieved two-thirds of our revenues through

value-added products.

With the moderation in almond prices,

Blue Diamond

is doubling

down on our marketing investments. We are debuting new

Almond Breeze

television advertising, committing to significant

advertising for snack almonds during the Olympics and

continuing to invest in new innovative products that will build

our growers’ bottom line.

Blue Diamond

will continue driving

market growth through innovative products and marketing,

ensuring a strong future for our cooperative.

Crop Year

August 2015

February 2016

5 Year Global Almond Pricing Cycle

94

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$4.50

$4.00

$5.00

96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16

95