Fall Insurance Update from RL Wells & Associates, Inc.

- California has increased the income levels to qualify for a tax credit in 2020. You may now qualify effective January 1, 2020! We have attached the 2020 income chart for your information. Please call us for details.

- California taxpayers will be assessed a new Tax Penalty for not having Qualified Health Insurance starting January 1, 2020

- Individual & Family Plans – OPEN ENROLLMENT starts November 1st!

- Plans available through multiple carriers depending on your home zip code. Potential Carriers include Anthem Blue Cross, Blue Shield, Kaiser Permanente, Health Net and more

- HMO, PPO, EPO and HSA compatible plans available depending on your home zip code

- Covered California Individual & Family Plans – OPEN ENROLLMENT starts October 15th!

- Tax Credit for those who qualify – Income levels are increasing so you may now qualify even if you didn’t in 2019

- For Coverage starting January 1st – Enroll between October 15th – December 15th

- For Coverage starting February 1st – Enroll between December 16th – January 15th

- Easy Issue Life Insurance – Only 3 Questions to Qualify

-

- Choose between Term Life or Whole Life – Several Riders Available

- Enroll by registering through us at https://protectedenrollment.com/RLWells/register

- Accident and Cancer Policy also available

- Dental Insurance and Dental Discount Options

-

- Multiple Carriers Available: Colonial, Delta Dental, Ameritas, United Health Care and more

- Dental Discount (15%-50%) available – NO WAITS – Aetna PPO Dentist ONLY – $5.50/month

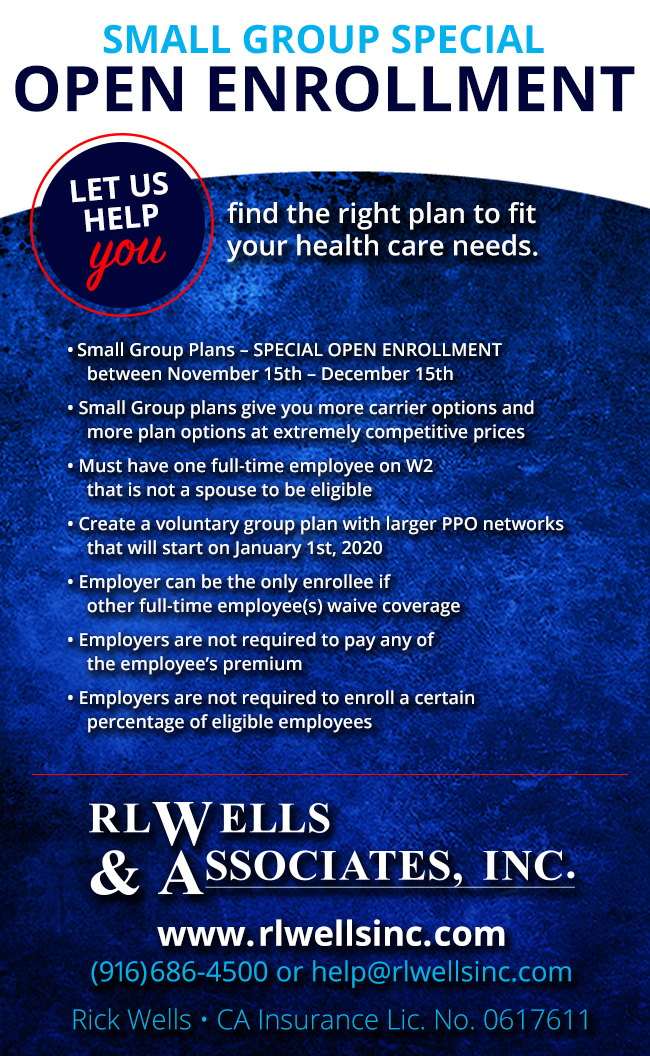

- FOR EMPLOYERS ONLY – Special Open Enrollment between November 15th – December 15th!

- If you have a full time employee please ask us for details!

For enrollment information, please contact RL Wells & Associates, INC www.rlwellsinc.com

Phone: (916) 686-4500 or (800) 568-4500 Fax: (916) 686-4514

Rick Wells – CA Insurance Lic. # 0617611 / Derek Traub – CA Insurance Lic. # 0F40632 / Nicole Schoen – CA Insurance Lic. # 0H61675

Helen Wells – CA Insurance Lic. # 0789719