Bill Morecraft

Senior Vice President

The Almond Board of California released the November 2017 Position Report this morning revealing a new monthly shipment record totaling 228.4 million lbs, up 21.8% over prior year. This marks the second straight monthly record this crop year. November’s shipments were the he 4th largest of all time, far exceeding shipment numbers typically seen in November between 2012 and 2016. Growth of 17% domestically and 23.7% across export markets put the industry ahead of prior year for the first time during the 2017 crop, now totaling 834 million lbs, +4.9%. Despite the slow start to this year’s harvest, shipment numbers have remained strong throughout, supporting the idea that current price levels are good for market demand.

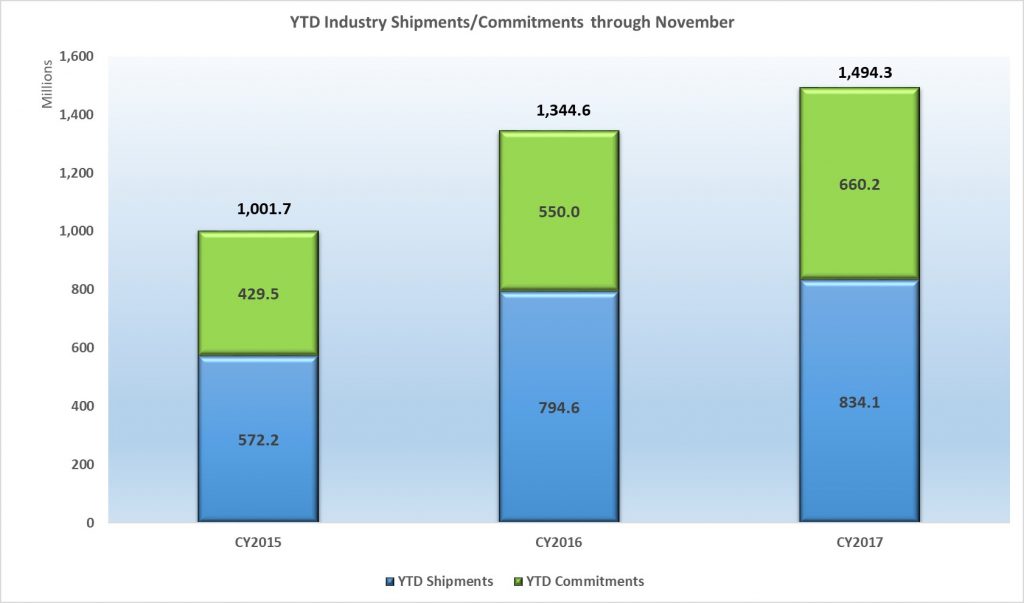

November receipts totaled just over 464 million lbs, eclipsing November 2016 totals by 24.9%. This healthy receipt number put the industry ahead of last crop year for the first time with total receipts at 1,993 million lbs, +3.27%. As we approach the Objective Estimate of 2.25 billion lbs, the number continues to look like a reasonable projection. Overall, shipments & commitments have reached 1,494.3 million lbs, or 58% of the anticipated supply.

India continues to see strong demand with 29.2 million lbs of in-shell shipments in November, up 24% on the year, now totaling 107.5 million lbs. While this volume was on the upper echelon of industry expectations, this growing market will not have issue consuming existing inventory with normal demand continuing through this winter and spring. Both the U.S. and Europe gained an additional 3% on prior year now seeing total growth of 6% and 10% YTD respectively. Domestically, the versatility and affordability of almonds continues to support inclusion in new product launches with manufactured products in the market up 13% YTD. While still somewhat lagging, China/Hong Kong is slowly beginning to see overall shipments approach 2016 YTD levels gaining 4% in November. Prospects in the market look optimistic for future growth.

Market Perspective –

Demand continues to be strong at the existing price levels removing any doubt the industry would have trouble consuming the anticipated 2.25 billion lb crop.

The industry concern regarding high serious damage and doubles continues to restrict availability of high quality inventory. As a result, supply of products such as NPX, those with tighter quality specs and certain sizes may be in short supply as we approach the next significant data point, bloom.

In the near term, firm prices should continue as the industry reacts to another record shipment number and continues to deal with the crop quality issues.

To View this report and other Market Updates visit our Global Ingredients site here:

Click here to view the entire detailed Position Report from the Almond Board of California site: